A significant mover of goods, with established infrastructure and networks in 38 countries on five continents, operated by approximately 30 000 employees.

Key investment highlights

- Leading positions in regional markets provide platforms for sustainable growth: market leader in South Africa, a leader in selected industries (consumer packaged goods (CPG) and healthcare) in the African Regions and in certain specialised capabilities in Europe.

- Competitive differentiation centred on agility and customisation: specialised capabilities across the value chain enable customised and integrated solutions, with service offerings and operating models tailored to client requirements and market maturity.

- Trusted partner to multinational clients: quality contract portfolio in high-growth and defensive industries, with partnerships demonstrating reach, capabilities, assets, innovation and legitimacy.

- Asset right business model underpins financial profile: more optimal asset mix and targeted returns on capital support prospects for sustainable revenue growth, enhanced profitability and cash generation.

- Vision to unlock benefits of “One Imperial Logistics”: strategy focused on sustainable revenue growth, enhanced returns and improved competitiveness, with initiatives to drive substantial organic growth enabled by a differentiated approach to digitalisation and innovation, and enhanced financial flexibility supporting selective acquisitive growth.

- Track record for consistent growth: proven ability to acquire, develop and leverage specialist capabilities to establish growth platforms in emerging and advanced markets.

- Strong and committed leadership: highly experienced, long-serving management team and a strong independent board.

An integrated outsourced logistics service provider…

South Africa |

African Regions |

International |

||

|

|

|

…with a diversified presence across Africa and Europe…

Revenue*

R51,4bn

Operating profit*

R2,8bn

Total

ROIC vs WACC

12,2% vs 8,5%

Total

Operating margin

5,6%

ROIC

WACC

Net debt/equity ratio

50%

- South Africa

- African Regions

- International

* Excludes head office and eliminations. Revenue percentage splits based on external revenue, excluding businesses held for sale.

…offering specialised capabilities and customised solutions…

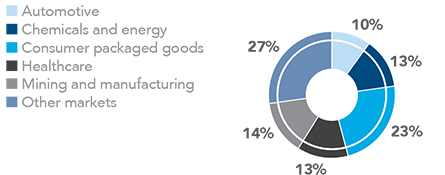

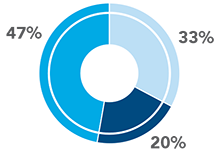

F2018 revenue split

…to multinational clients in attractive industries.

F2018 revenue split