Our performance

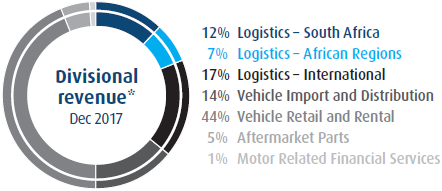

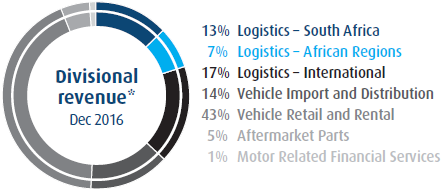

*Excludes discontinued operations, businesses held for sale and head office and eliminations.

Note: Prior year restated for VAPS reallocated from discontinued to continuing operations (R36 million increase in operating profit) and prior year restatement (R40 million increase in operating profit).

*Excludes discontinued operations, businesses held for sale and head office and eliminations.

Note: Prior year restated for VAPS reallocated from discontinued to continuing operations (R36 million increase in operating profit) and prior year restatement (R40 million increase in operating profit). ROE, ROIC and WACC are calculated on a rolling 12 month basis based on continuing operations.

The transformation and development of Imperial in recent years has been directed at value creation through strategic clarity, managerial focus and shareholder insight. The first is being achieved through portfolio rationalisation, the second through organisation structure and the third through disclosure.

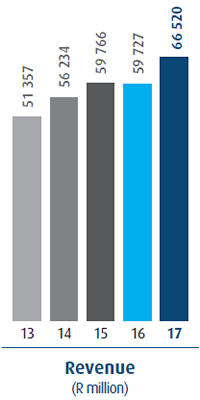

- Imperial produced solid results and an improvement in all key financial metrics in the six months to 31 December 2017, supported by acquisitions, increased vehicle sales in Motus and a good performance from Imperial Logistics, particularly in South Africa.

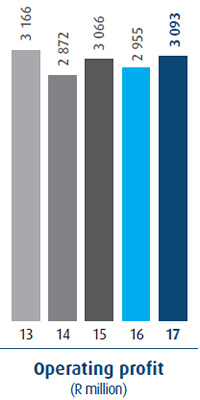

- Excluding current and prior period acquisitions and disposals, total revenue for the group increased by 5% and operating profit remained stable.

- Operating margin declined from 4,9% to 4,6%, resulting from a reduction in luxury vehicle brands in favour of smaller lower margin entry level vehicles and the acquisition by Motus of the lower margin Pentagon (UK) and SWT (Australia) businesses.

- Foreign revenue increased 20% to R30,7 billion (46% of group revenue) and foreign operating profit increased 4% to R1,1 billion (35% of group operating profit).

- Non-vehicle revenue increased 5% to R27,0 billion (41% of group revenue) and operating profit increased 7% to R1,4 billion (45% of group operating profit).

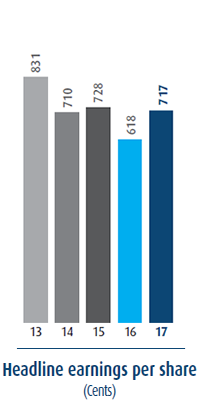

- A full reconciliation from earnings to headline earnings is provided in the group financial performance section. Core earnings is no longer a relevant financial measure and has been discontinued.

- Net working capital of R8,9 billion was in line with June 2017 (R11,1 billion at December 2016).

- Disposals of non-strategic businesses and properties during the six-month period generated proceeds of R693 million (excluding Schirm). Net assets held for sale amounted to approximately R2,5 billion, comprising non-strategic properties, Schirm and Transport Holdings.

- An interim cash dividend of 323 cents per ordinary share has been declared.