Our governance

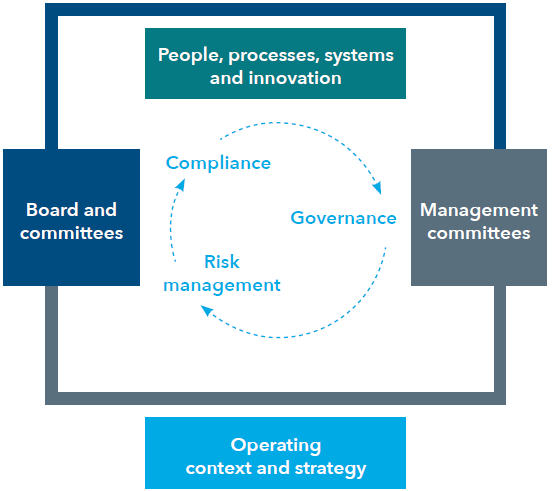

Our approach to corporate governance is aligned to our clearly defined purpose and underpinned by an integrated governance model that goes beyond compliance.

Good corporate governance supports business integrity, ethical behaviour and accountability for decisions regarding economic, social and environmental impacts in the short, medium and long term. Being united behind a clearly defined common purpose – connecting Africa and the world and improving people's lives with access to quality products and services – allows us to create sustainable long-term value, embed good governance principles throughout our business and be a truly purpose-led organisation prioritising people, planet and profit.

Our governance framework

Our approach to corporate governance is implemented through our integrated governance model, which extends our commitment to good governance beyond compliance. Good governance supports business integrity, ethical behaviour and accountability for decisions that have economic, social and environmental impacts in the short, medium and long term. Being a responsible corporate citizen underpins our industry, market and country legitimacy, which not only secures our commercial licence to operate, but is also a competitive advantage.

We subscribe to, and apply, the King IV principles of good governance. The board believes that the King IV principles and recommended practices are sufficiently embedded in the operational life of the group. The board expects and encourages continuous work to achieve the governance outcomes of ethical culture, good performance, effective control and legitimacy.

Our integrated governance model

We subscribe to, and apply, the King IV principles of good governance. The board believes that the King IV principles and recommended practices are sufficiently embedded in the operational life of the group. The board expects and encourages continuous work to achieve the governance outcomes of ethical culture, good performance, effective control and legitimacy.

Our full corporate governance report, incorporating our application of the principles of King IV, is available as part of our shareholders report.

Leadership and ethics

Our board

Ultimate responsibility for governance rests with our board and its committees. The group has a unitary board comprising eight non-executive directors, seven of whom are independent, and two executive directors.

The authority, responsibility and accountability of the group's ethics, performance and sustainability rests with the board. The board formally delegates responsibility to the CEO and his direct reports and sequentially throughout the organisation in accordance with written limits of authority.

Skills and experience

The group has a well-constituted and diverse board, with expertise and experience relevant to the strategy and operating context within which the group operates, and the necessary independence and oversight underpinned by strong governance and control processes that support strategic delivery and corporate reputation.

The non-executive directors have the necessary skills and expertise to make judgements, independent of management, in strategy design, integrated performance, business development, transformation, diversity, ethics and ESG management.

Responsibilities of the board

The responsibilities of the board are clearly defined in a written charter. The board charter outlines a clear balance of power and authority within the board to ensure that no single director has unfettered powers of decision making.

The responsibilities of the board include guiding and approving the strategic direction, business plans, annual budgets, major acquisitions and disposals, changes to the board and other matters that have a material effect on the group or are required by legislation.

The board has adopted and regularly reviews a written policy governing authority delegated to group management and matters reserved for decision by the board.

Board diversity

The board has a formal broad diversity policy governing diversity at board level. The board takes this policy into account when making board appointments.

Wide range of experience in commerce, finance, law and industry.

Board succession and appointment

Directors are appointed based on their skills, experience and expected level of contribution to, and impact on, the activities of the group. The board decides on the appointment of directors based on recommendations from the nominations committee.

Separation of roles and responsibilities

The role of the chairman of the board is clearly defined and separate from that of the CEO. While the board may delegate authority to the CEO in terms of the board charter, the separation of responsibilities is designed to ensure that no single person or group can have unrestricted powers and that appropriate balances of power and authority exist on the board.

Independence

Ms P Langeni is the current non-executive chair of the board. She is a shareholder in a B-BBEE partner of the group and is consequently not considered to be independent. The board has a formal protocol to govern potential conflicts of interest. In addition to the chair recusing herself where matters in which she has an interest are discussed, in compliance with the Companies Act, any decisions in or regarding the B-BBEE venture that could benefit or be seen to benefit the chair or her associates are deferred to the unconflicted members of the nomination committee in accordance with the formal protocol. This includes matters such as dividend payments and fundamental business decisions.

Changes to the board

Mrs NB Duker (née Radebe) has been appointed as chairman of the audit and risk committee from 1 September 2020.

Ms HO Adesola and CH Anammah were appointed as independent non-executive directors of Imperial from

22 February 2021.

Climate-related risks and opportunities

The board, under the leadership of the board chairman, is responsible for climate-related issues, including assessing the identified climate-related risks and opportunities and the effectiveness of the management thereof and reviewing the resilience of the business strategy considering identified climate-related risks and opportunities.

Independent board

Imperial constituted an independent board whose responsibilities and duties are set out in the Takeover Regulations.

Read more about our independent board.

Governance in action

Board and board committees

The board has established a number of sub-committees, including statutory committees, all of which operate within written terms of reference. The performance of each committee, and compliance with its terms of reference, is regularly assessed in accordance with their terms of reference. No instances of non-compliance were noted.

The board and committees below reflect the current composition and memberships at publication.

More information, including details of the divisional boards, is provided in the full corporate governance report.

Board of directors

Non-executive directors

GW Dempster* (lead independent director)

HO Adesola*1

CJ Anammah*1

P Cooper*

NB Duker*

D Reich*2

RJA Sparks*

Executive directors

JG de Beer

* Independent

1 Nigerian

2 Swiss

Board focus areas for the year

- Ongoing impact of COVID-19.

- Review and approval of significant acquisitions and disposals and other mergers and acquisitions related activity.

- Consider the DP World offer, establishing an independent board.

- Oversight of key strategic initiatives and progress.

- The approval of the group-wide ESG and climate change policies and guidelines, and the advancement of ESG reporting standards and global membership and the creation of a Corporate Social Investment (CSI)/ESG committee, a dedicated sub-committee of the social, ethics and sustainability (SES) board committee.

Board effectiveness evaluation

During F2021, an independent board effectiveness review was undertaken by an experienced external consultant. The review was conducted using a web-based questionnaire supplemented by interviews with the members of the board and the outgoing company secretary.

The overall outcome of the review was that board is operating effectively and that appropriate processes and systems are in place to ensure compliance with legal requirements and to make informed decisions. The board sub-committees are considered to be best-in-class in fulfilling their responsibilities. Some areas identified for improvement included improved CEO and senior management succession planning, and supplementing the existing skills on the board with skills that complement the group’s ‘One Imperial’ and ‘Gateway to Africa’ strategy.

Board committees

Nomination committee

| Responsibility | Key activities for F2021 | Attendance at | |

| Provides advice and guidance on succession planning, director appointments and director induction and training. |

|

100% |

|

Remuneration committee

| Responsibility | Key activities for F2021 | Attendance at | |

| Advises and guides the board of directors' remuneration, setting and implementing the remuneration policy, approval of general composition of remuneration packages and criteria for executive bonus and incentive awards, and administration of share-based incentive schemes. |

|

100% |

|

More information, remuneration insights from the committee chair in the shareholder report.

Independent board

| Responsibility | Attendance at | |

| The independent board was constituted in accordance with Regulation 108 of Chapter 5 of the Companies Regulations, 2011 (the Takeover Regulations). According to Regulation 110 of the Takeover Regulations, it is the responsibility of an independent board to form a clear basis for the expression of an opinion to shareholders around the value of an offer. | 100% |

|

From the independent board chair: Graham Dempster

In terms of the Companies Act, the DP World offer required that we form the independent board to perform various functions including advising shareholders on the merits of the offer. We conducted this detailed process not only according to the exacting prescripts of the relevant legislation, but also in the full spirit of our mandated duties.

The independent board was constituted in accordance with Regulation 108 of Chapter 5 of the Takeover Regulations. According to Regulation 110 of the Takeover Regulations, it is the responsibility of an independent board to form a clear basis for the expression of an opinion to shareholders on the value and price of the consideration offered.

The independent board was constituted following receipt of the non-binding offer from DP World, and once the bona fides of the offer had been established, considering all relevant factors. The independent board was made up of all members of the main board of directors that are independent, thereby excluding the executive directors and the Imperial board chairman, who is also a B-BBEE partner to the group. As the lead independent non-executive director, I was appointed to chair the independent board.

Although an independent board can legally be constituted with only three members, we included all independent members of the Imperial board, which made for a team of seven independent non-executive directors. Given that we had 10 meetings, there was ample opportunity for all members to participate fully in the process. Key decisions were discussed exhaustively, and all our resolutions were unanimous.

One of the key functions as the independent board was to appoint an independent expert to advise on whether the offer was fair and reasonable, an expert in no way conflicted by an existing relationship with any part of the group. After rigorous evaluation and discussion, we chose Swiss multinational investment bank, UBS, renowned for their expertise in international mergers and acquisitions.

We also sought advice from various other parties, including Imperial’s appointed advisors, and took steps as required in terms of the Companies Act to reach a fully informed decision. The independent board also took responsibility for relevant considerations, in the context of the DP World offer, related to Imperial’s long-term incentive schemes and our significant B-BBEE ownership transaction, concluded during the year. These considerations are more fully described in the combined circular to shareholders in respect of DP World’s offer.

I am confident that the independent board has discharged its duties in a way that not only comply with the relevant legislative requirements, but which also reflect Imperial’s commitment to best governance practice. Also, the skillsets and experience around the table enabled us to assess all relevant factors – whether difficult to quantify or even unquantifiable – to form a cogent, transparent and unanimous opinion in respect of the fairness and reasonableness of the transaction and value ascribed to the group, in the best interest of our shareholders.

The circular posted to shareholders on 19 August 2021 sets out the opinion of the independent board, and the terms and rationale for the DP World offer, and can be found online at www.imperiallogistics.com/offer-by-dp-world.php.

Asset and liability committee (ALCO)

| Responsibility | Attendance at | |

| Responsible for implementing best practice asset and liability management policies. Its primary objective is to manage the liquidity, debt levels, interest rate and exchange rate risk of the group within an acceptable risk profile. | 97% |

|

From the ALCO chair: Peter Cooper

The role of the ALCO is to keep a close watch on risks and opportunities related to liquidity, foreign exchange, interest rates and debt capital raising. Investors can take comfort that Imperial has the liquidity to continue operations in the short and medium terms; and that the allocation of surplus funds is aligned to long-term strategic goals. We also provide management with a sounding board for decision making as they navigate trade-offs in the allocation of resources. Management sets the strategy, but we interrogate that strategy and ground it in the realities and risks we see playing out over the coming years.

In one of our biggest deals, Imperial recently announced the acquisition of the J&J Group, which specialises in shifting cargo on the Beira as well as the North-South corridor between South Africa, Zimbabwe, Zambia, Mozambique, Malawi and the Democratic Republic of Congo (DRC). Here was an example of giving management a sounding board to interrogate whether the acquisition fits our strategy. Similarly, there were lengthy and searching discussions around the merits of various other investments, acquisitions and disposals; for example Deep Catch Namibia Holdings and the sale of the shipping businesses. The impact of these transactions on our balance sheet and earnings are appraised against bank covenants on our lending facilities to ensure that there is no risk of these being breached.

We are guided in these discussions by our commitment to transform Imperial into an innovative asset-right business that uses data and technology as a differentiator, while bearing in mind that hard assets will always be a necessary part of our supply chains. To get the balance right, we are looking for opportunities to deliver contract logistics and road freight with a lighter asset base. Our Innovation Venture Fund is dedicated to delivering on this aspiration to become more asset right.

I am confident in our assets and liability management disciplines and without going into detail, refer you to the chief financial officer’s (CFO) report, from page 55, which I endorse. I take heart from the DP World offer as affirming Imperial’s estimation of the long-term potential in African markets. I am satisfied that irrespective of whether the sale goes through or not, we have the appropriate funding and capital structures for the group; and our balance sheet is in excellent shape to deliver on our strategy and grow shareholder returns. On 17 September 2021, the requisite majority of Imperial shareholders voted in favour of the transaction which is still subject to regulatory approvals.

ESG is a pillar of our strategy and this committee also realises the need to have a sound long-term plan in place that gives lenders comfort and assurance that our ESG commitments are real, achievable and measurable. Management is evaluating a number of proposals from funders that incorporate ESG components for green-finance facilities.

My personal highlight for the year is how non-executives and management related to each other in achieving our goals. In the spirit of mutual respect and commitment to professional excellence we got to the right answers without having to engage in long, acrimonious arguments; and without needing to resort to tie-breaking votes. In our discussions and debates, decision makers voiced valid concerns and allowed themselves to be persuaded by the merits of the argument: for the good of Imperial and the execution of our well-rounded strategy.

Audit and risk committee (ARC)

| Responsibility | Attendance at | |

| Assists the board in its responsibilities, covering the internal and external audit processes for the group,

taking into account significant risks, the adequacy and functioning of the group’s internal controls and

the integrity of financial reporting. Sets the group’s risk culture, framework and ensures that robust risk management processes are in place. |

100% |

|

From the ARC chair: Bridget Duker

The ARC leads Imperial’s corporate governance effort and is central to setting our appetite and tolerance for risk in a manner that aligns to and complements Imperial’s ‘One Imperial’ and ‘Gateway to Africa’ strategy.

To this end, the committee focuses on material threats to our business and ensures appropriate safeguards are in place, by reviewing the adequacy of our risk systems, internal control processes and supporting management’s commitment to mitigating risk. In discharging our fiduciary responsibilities to all our stakeholders, we have ensured the effectiveness of the organisation’s assurance functions and services, with a particular focus on the appointment of the external and internal auditors as providers of independent assurance on financial and related reporting.

In my first full financial year in the position of ARC chair, it has been exciting to be part of the strategic shift to ‘One Imperial’ and ‘Gateway to Africa’. I am greatly heartened by the skill and commitment of our executive team and their balance of attributes, which drives their pursuit of our vision. I have been pleased by the conversations we have had both at the ARC and board level. Our debate is robust and constructive, offering executives oversight and governance parameters to give them the confidence to take bold decisions.

As Imperial goes through its wide-reaching strategic transformation and restructuring, the consequential changes in reporting parameters are being well managed. Great care is being taken to continue providing balanced and transparent reporting to foster a deeper understanding and visibility of the impacts of the strategic decisions taken. As a result, we have confidence that the board has sufficient visibility of important operational detail on the ground. This is further strengthened by the fact that we have a non-executive director (who is a member of ARC) attending each business level financial and risk review committee (FRRC) meeting. From their reports and from our mature assurance processes, I can confirm there is corroboration that our strategy is delivering on financial expectations, and our system of internal controls is sound.

I would like to commend the FRRCs within each business. These committees are another line of defence in our combined assurance procedures. I can report that my dealings with Imperial’s FRRCs have been most encouraging. The managers on these committees display a high level of professionalism. There is a culture of accountability and care in doing what is good for Imperial as a whole, as opposed to being only concerned with one’s business.

We have seen an unprecedented level of corporate activity, which has occupied both management’s attention and the committee’s time in ensuring that this has been navigated in a manner that is above reproach with regulators, while responsibly making use of expert advisers at the appropriate times. On mergers and acquisitions, the committee engaged management on progress made in exiting certain non-core businesses and acquiring others with better strategic alignment. Our challenge to management was to resolve the residual costs of legacy businesses and redirect the savings to our strategy. Similarly, we probed how well the integration of newly acquired businesses was faring and whether the synergistic benefits were beginning to be realised. In this regard I am very happy with the progress achieved.

The committee approved Imperial’s redrafted Risk Policy, the Risk Appetite and Risk Tolerance statements, and the updated Risk Standard. You will find the full detail on these under the section Our risks and opportunities, from page 44. While we acknowledge the urgent need to integrate ESG and climate change risk management into our governance and risk management structures, this is still in its infancy on ARC’s agenda. It will be an area of key focus for the next and subsequent years. You can read more about our TCFD disclosures in our ESG report.

This committee notes the new JSE Listings Requirements that require the CEO and CFO to endorse, with a positive statement, the internal financial control environment (section 3.84(k)). A truly robust assurance process was undertaken in collaboration with external auditors, internal auditors and a network of risk and compliance functions, led by the group’s chief risk officer. The culmination of which was a confirmation of the design and implementation of sound internal financial controls, which permeate throughout the group to give credibility to our financial reporting. Our CEO and CFO, and the board by way of this committee, are well supported in assuring shareholders of our financial controls. It takes a team to produce solid reporting, which has real value in informing leadership and management decisions, and accounting accurately to stakeholders.

As reported last year, the Independent Regulatory Board for Auditors has determined that from 2023 all South African public interest entities must comply with mandatory audit firm rotation. Our preparations for this are well advanced and we will be ready for the change. Further, in November 2020, Rohan Venter resigned as company secretary and was replaced by Imperial’s group legal executive, Jeetesh Ravjee, who is acting as company secretary until a permanent replacement is found. In January 2021, we changed our JSE sponsor from Merrill Lynch to Rand Merchant Bank. In all these changes we have followed the letter and spirit of regulation.

Imperial continues to grow our capability to respond fully and timeously to changes in legislation across our jurisdictions, supported by ongoing awareness and training campaigns to sensitise staff to their obligations to company policies that support full compliance with the regulatory universe. These encompass newly promulgated acts such as General Data Protection Regulation and Protection of Personal Information Act (POPIA) and extend to risks and threats such as cyber security and other information technology risks. Imperial is well positioned to address both existing and emergent ICT legislation and regulations. The ARC continues to review data privacy and information security strategies and to monitor the implementation of cyberrelated controls.

As the world continues to manage the impacts of the COVID-19 pandemic, we take comfort from the resilience our businesses have shown during this trying period and commit to remaining vigilant in the face of new risks and threats, wherever these may appear.

Social, ethics and sustainability committee

| Responsibility | Attendance at | |

| Assists the board in discharging its SES responsibilities and implementing practices consistent with good corporate citizenship. | 100% |

|

From the SES committee chair: Roddy Sparks

We are the social conscience of Imperial. The SES committee guides and oversees the organisation on matters of ethics and broader responsibility to society, the environment and key stakeholders.

Imperial is thoroughly embedded in the economies and societies in which we operate. Aligned with our purpose, we help bring food, medication, fuel and other essential products and services to over 20 African countries, many of them among the world’s poorest. Across our African and International operations, in 25 countries, we support the supply chains of industries that give millions of people decent jobs and opportunities to better their lives.

Imperial’s contribution to economies and societies cannot be easily reduced to monetary value. There are, after all, human stories and aspirations behind the numbers. According to a recent socioeconomic impact assessment by Accenture, in F2019 and F2020, we created direct and indirect value of R146 billion and R98 billion for stakeholders in Nigeria and South Africa, respectively.

Ethics and social good are not add-ons for our business, they are embedded in our purpose and strategy. By following the highest standards of business ethics, people and product safety, we ensure we remain credible partners to clients, principals and customers in industries that have strict codes of propriety within their supply chains, like healthcare. They hold us to account on our ESG scorecards; their assessment of our credibility shapes our brand image and reputation.

Noteworthy here is that stringent health and safety practices are a top priority for Imperial, and our values emphasise that peoples’ safety comes first. Our safety management frameworks and systems align to relevant legislation in each country of operation and to the safety, health and environment (SHE) requirements of our clients and principals and customers. The committee is heartened that the group is developing and embedding a standardised SHE framework and best-in-class safety, health and security practices across our African operations. In South Africa, our safety audit protocols are benchmarked with those of major clients and principals. Annual safety self-assessments are conducted in South Africa and Europe by internal safety specialists or external certified experts (with oversight from internal audit) to ensure we comply with the relevant legislation.

Road accidents remain the cause of most of our workplace fatalities and injuries, although road usage on the continent makes this a difficult and, in many instances, an uncontrollable safety risk. We ensure our drivers understand their responsibilities on the road and implement the best road safety practices to protect them and other road users. We employ technology, telematics and driver awareness to improve our processes, achieve cost savings and address road safety and environmental risks.

Please refer to our online ESG for more detail on our response to climate change.

Most of our employees who tested positive for COVID-19 have made full recoveries. To bolster our COVID-19 response, in the year we began providing COVID-19 care packages to affected employees, and in August 2021 opened a temporary vaccination site for employees at our Alberton operation. Sadly, 24 of our colleagues succumbed to the virus and we extend our deepest condolences to their loved ones.

Our strategy has as one of its six pillars “Integrating ESG practices”. During the year we formulated a comprehensive ESG strategy, which the board approved in May 2021, with clear targets that will enhance our competitive positioning. Our ESG aspiration is striving for zero harm to people and the environment – transitioning towards net zero carbon by 2050. Focus is now on change management and ESG strategy implementation, with detailed key performance indicator (KPI) dashboards to follow. For now, we are delighted that our ESG systems and performance have received favourable ratings from EcoVadis, Institutional Shareholder Services (ISS), and Carbon Disclosure Project (CDP); and we look forward to building on this success, including additional reporting against commitments such as the UN Global Compact.

In July 2021, we were confronted with unrest and looting in KwaZulu-Natal and Gauteng, South Africa. We are a business and therefore we do not hold any political position, other than what should not be up for debate – the rule of law and commitment to the Constitution. Strong, caring nations create a stable environment for business to grow and citizens to find opportunity. Corporations can help strengthen states, by rendering services, providing jobs and generating efficiencies and profits for reinvestment.

Our response to the July unrest was humanitarian. With the help of partners, we delivered food parcels to affected employees and their families, and donated to the charitable organisations who were active during that troubling time.

There are global societal issues that concern us too. Scientists have been warning us for some time now that our technological and industrial progress has come at a terrible cost to nature. Currently the world’s atmosphere carries around 410 parts per million (ppm) of carbon dioxide. The last time CO2 was this concentrated was three million years ago, when the temperature was two to three degrees Celsius higher; and sea levels were 15 to 25 metres higher. How can Africa be part of the solution, while also endeavouring to catch up on industrial development, in terms of the business of decarbonisation and ‘carbon tech’, Africa is mostly a follower. In 2021, America will invest around USD60 billion on climate tech. And – according to Bloomberg – in 2020 investors globally spent USD500 billion on the “energy transition”. The committee will continue to urge management to leverage transfers of green technology and climate finance from advanced economies to developing ones, in advancing solutions that create economic growth and export opportunities through new industries, such as green hydrogen. And our commitment to digital and data initiatives will help facilitate a shift. For example, our Project Blue Fleet uses data-driven insights to maximise efficiency and minimise resource waste.

Imperial conducted a gap analysis of our reporting against the TCFD requirements, and as we progress our ESG strategy we will improve our TCFD reporting. Further, the SES committee has approved the Imperial aspiration to strive for zero harm to people and the environment to frame our ESG strategy. In keeping with our commitment to greener logistics and new revenue opportunities we are considering strategic partnerships on alternative energy including compressed natural gas, liquified natural gas and green hydrogen.

To end, our view is that ordinary Africans will not reap the benefits of the continent’s extraordinary resources and demographic dividend if gatekeepers insist on bribes, and business pays those bribes to facilitate profitmaking. This year we engaged in an extensive communication campaign to remind our over 25 000 employees that we have zero tolerance for dishonest conduct. Ethical leadership and conduct vested in morality incorporates the full range of ESG imperatives and is the underpin to our legitimacy in the markets and industries we serve. We will continue to protect Imperial’s legitimacy, not only as a moral injunction, but also a competitive advantage.

Please refer to the ESG report