Remuneration overview

Our approach to remuneration is consistent with, and supports, our strategic value drivers and purpose and is underpinned by the establishment of equitable market-related pay practices.

Remuneration policy summary

Remuneration strategy

Imperial is committed to attracting, retaining and motivating a skilled and professional workforce that is effectively managed within a performance-driven environment, ensuring the long-term sustainability and transformation of the group in alignment with its strategy.

Remuneration philosophy

Imperial's reward philosophy provides the foundation for our guiding principles, which in turn determine how reward processes operate.

The group's reward philosophy aims to:

- Implement fair and equitable pay structures aligned to best practice.

- Recruit high-performing talent with relevant skills in a highly competitive labour market.

- Retain employees who enhance the group's performance and support the achievement of its strategy and vision.

- Motivate and reward individual and team performance enabling ongoing growth and sustainability.

- Recognise business-specific goals and reward employees appropriately for achieving them.

- Manage the total cost of employment in a cost-effective and appropriate manner, aligned with the group's core values and strategic objectives.

- Enable transformation across the group with remuneration practices that are fair, equitable and supportive of diverse needs and free of unfair discrimination.

- Comply with applicable legislation, organisational policies and conditions of service.

Remuneration principles

The remuneration principles that underpin our remuneration policy are:

Equitable pay

Individuals are compensated fairly for a specific role, with due regard to skills and performance.

Transformation

We are committed to attracting, retaining and fast-tracking talent to support organisational transformation.

Pay-for-performance

We continue to strengthen the link between remuneration and performance through our performance management system.

Transparency and governance

The process of reward management is transparent and conducted in good faith and under sound governance, with appropriate levels of confidentiality.

Competitive pay levels

Remuneration is competitive relative to the labour market.

Cost management

We set and manage reward levels and practices that provide a compensation package that is fiscally responsible, market competitive and sustainable over time.

Performance targets

Incentive plans, performance measures and targets are structured to operate consistently throughout the business.

Strategic alignment

We will provide a consistent compensation strategy, aligned to group and business objectives, where possible.

Rewarding our people has a direct impact on operational expenditure, performance, strategic delivery and execution, organisational culture, transformation, employee behaviour and ultimately the sustainability of the group. The group's remuneration policy seeks to attract and retain quality employees at all levels. Remuneration is structured to be competitive and relevant in the sectors in which the group operates, and businesses and functions review their remuneration policies regularly.

Elements of remuneration

|

Fixed remuneration Fixed remuneration is the total guaranteed package before short-term incentives. |

Annual short-term incentives All executives are eligible for a performance-based short-term incentive. |

|

|

Share-based long-term incentives The group has two long-term incentive plans in place and participation is based on a range of criteria. |

Other benefits These include participation in contributory retirement schemes. |

Annual short-term incentive criteria

The short-term incentive criteria differ depending on the position of each executive and the business or function in which they operate.

| F2021 criteria | F2022 criteria | ||

|

|

| CEO and CFO short-term incentive performance measures for F2021 | Weighting | |

| Group year-on-year organic revenue growth* | 10% | |

|---|---|---|

| Group year-on-year EBIT growth* | 10% | |

| Achievement of budgeted cost savings | 10% | |

| Achievement of group ROIC target (>0% up to 2% over WACC) | 15% | |

| Group year-on-year HEPS growth* | 15% | |

| Strategic execution, including achieving transformation targets | 40% |

| * | The threshold is determined as 80% of the group target for each measure. Payment will be zero if the actual is below 80% and will be pro-rated if it is between 80% and 100%. |

| CEO and CFO short-term incentive performance measures for F2022 | Weighting | |

| Group year-on-year organic revenue growth* | 20% | |

|---|---|---|

| Group year-on-year EBIT growth* | 20% | |

| Achievement of group ROIC target (>0% up to 2% over WACC) | 15% | |

| Group year-on-year headline earnings growth* | 15% | |

| Strategic execution, including achieving transformation and gender targets | 30% | |

| – Digital and IT priorities | ||

| – People priorities | ||

| – ESG priorities |

| * | The threshold is determined as 90% of the group target for each measure. Payment will be zero if the actual is below 90% and will be pro-rated if it is between 90% and 100%. |

Proposed impact of DP World offer on LTI schemes

The proposed DP World transaction will have the following impact on the LTI schemes:

- Deferred bonus plan (DBPs)

All rights under the DBPs will have vested prior to the implementation of the proposed transaction.

- Conditional share plan (CSPs) and share appreciation rights (SARs)

Rights granted under the CSPs and SARs that will vest prior to the implementation of the proposed transaction will be subject to the fulfilment of current performance conditions, and will either be settled in Imperial ordinary shares as per the LTI scheme rules, or cash at the consideration of R66 per Imperial ordinary share as per the proposed transaction as soon as reasonably possible after it has been implemented.

The board has resolved to apply the rules of the CSPs and SARs to the rights granted under each scheme which have not vested prior to the implementation of the proposed transaction and therefore:

- A time-based pro-rata will be applied to the unvested rights, where a portion of these will vest on the change of control of Imperial under the proposed transaction.

- Has determined, following consultation with the group's external, independent remuneration advisor and using its discretion, that 65,17% of the value of the time pro-rated portion will be settled in cash as soon as reasonably possible after the proposed transaction has been implemented, while the remaining 34,83% of the time value of the pro-rated portion of unvested rights will lapse.

The rules of the CSPs and SARs will be amended to take into account the delisting of Imperial from the JSE after the implementation of the proposed transaction to provide that the remaining unvested rights in the CSPs and SARs LTI schemes be cash settled, in terms of the amended rules, at the scheme consideration of R66 per Imperial ordinary share.

Remuneration implementation summary

Executive remuneration

The group remunerated its executive directors during the year as explained below.

M (Mohammed) Akoojee – Group CEO

Mohammed received a total fixed compensation and benefits of R11 236 000 (2020: R10 343 1321) for the year and a short-term incentive of R14 998 000 (2020: R7 116 000), based on performance measures applicable to the group CEO.

| 2021 measures | Weighting | Performance against target |

|

| Group year-on-year organic revenue growth | 10% | 7% | |

|---|---|---|---|

| Group year-on-year EBIT growth | 10% | 10% | |

| Achievement of budgeted cost savings | 10% | 10% | |

| Achievement of group ROIC target (>0% up to 2% over WACC) | 15% | 9,8% | |

| Group year-on-year HEPS growth | 15% | 13,4% | |

| Strategic execution, including achieving transformation targets | 40% | 38,8% | |

| Maximum as percentage of fixed compensation | 150% | 133,5% |

In determining the strategy execution element of his STI, the committee considered Mohammed's performance against the clear targets set for each of the six strategic pillars.

M (Mohammed) Akoojee – Group CEO

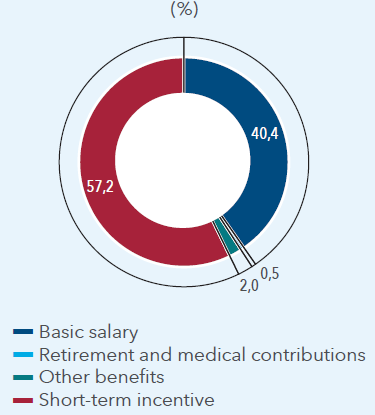

2021 remuneration

JG (George) De Beer – Group CFO

George received a fixed compensation and benefits of R6 114 000 (2020: R5 696 891) for the year and short-term incentive of R8 130 000 (2020: R3 654 000), based on performance measures applicable to the group CFO.

| 2021 measures | Weighting | Performance against target |

|

| Group year-on-year organic revenue growth | 10% | 7% | |

|---|---|---|---|

| Group year-on-year EBIT growth | 10% | 10% | |

| Achievement of budgeted cost savings | 10% | 10% | |

| Achievement of group ROIC target (>0% up to 2% over WACC) | 15% | 9,8% | |

| Group year-on-year HEPS growth | 15% | 13,4% | |

| Strategic execution, including achieving transformation targets | 40% | 38,8% | |

| Maximum as percentage of fixed compensation | 150% | 133,5% |

In determining the strategy execution element of his STI, the committee considered George's performance against the clear targets set for each of the six strategic pillars.

JG (George) De Beer – Group CFO

2021 remuneration

Prescribed officers' remuneration

Prescribed officers are persons, not being directors, who either alone or with others exercise executive control and management

J (Johan) Truter – CEO: Market Access

Johan received a fixed compensation and benefits for 2021 were R5 407 000 (2020: R4 553 138) for the year and a short-term incentive of R4 663 000 (2020: R2 115 000).

| 2021 measures | Weighting | Performance against target |

|

| Group financial performance | 20% | 17% | |

|---|---|---|---|

| Divisional organic revenue growth | 10% | 7,6% | |

| Divisional EBIT growth | 20% | 16,5% | |

| Divisional free cash conversion | 20% | 16,0% | |

| Strategic execution, including achieving transformation targets | 30% | 29,2% | |

| Maximum as percentage of fixed compensation | 100% | 86,3% |

In determining the strategy execution element of his STI, the committee considered Johan's performance against the clear targets set for each of the six strategic pillars.

J (Johan) Truter – CEO:

Market Access 2021 remuneration

H (Hakan) Bicil – CEO: Logistics International

Included in the short-term incentives awarded to Hakan was an amount related to strategy execution specifically the successful disposals of the European and South American shipping businesses. These disposals were successfully executed by Hakan and the Logistics International team during tough trading conditions, compounded by COVID-19, and realised c.R4,7 billion for the group.

| 2021 measures | Weighting | Performance against target |

|

| Group financial performance | 20% | 17% | |

|---|---|---|---|

| Divisional organic revenue growth | 10% | 9,4% | |

| Divisional EBIT growth | 40% | 40,0% | |

| Divisional free cash conversion | 30% | 30,0% | |

| Maximum as percentage of fixed compensation | 100% | 96,4% |

H (Hakan) Bicil – CEO:

Logistics International 2021 remuneration

E (Edwin) Hewitt – CEO: Logistics Africa

Edwin received total fixed compensation and benefits of R5 777 000 (2020: R1 648 022) and a STI of R5 552 000 (2020: Rnil). Edwin joined the group in March 2020.

| 2021 measures | Weighting | Performance against target |

|

| Group financial performance | 20% | 17% | |

|---|---|---|---|

| Divisional organic revenue growth | 10% | 10% | |

| Divisional EBIT growth | 10% | 10% | |

| Achievement of budgeted cost savings | 10% | 10% | |

| Divisional free cash conversion | 20% | 20% | |

| Strategic execution, including achieving transformation targets | 30% | 29,1% | |

| Maximum as percentage of fixed compensation | 100% | 96,1% |

In determining the strategy execution element of his STI, the committee considered Edwin's performance against the clear targets set for each of the six strategic pillars.

Read our full remuneration report in the shareholder report online.

E (Edwin) Hewitt – CEO:

Logistics Africa 2021 remuneration